Selling puts on margin

Selling puts on margin. Basically I sold 2 vertical spreads for 30 DTE for a stock and closed it with 10 days left to expiration.

Selling Naked Puts Selling Naked Calls Poweroptions

At 125contract if you close your position now its a 1K loss 125-25 10 100 1000 which is about 4 weeks of selling naked puts.

/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

. Once an option has been. Rates subject to change. Rates subject to change.

Margin rates as low as 283. Short puts may be used as an alternative to placing buy limit orders. Margin rates as low as 283.

100 Cost of the Option. It bounces back to 53 on Tuesday but the. Answer 1 of 2.

Normally just sell covered calls and Im new to margin usage. What you need to know. The margin requirement for an uncovered put is the greatest of the following calculations times the.

The option margin is the cash or securities an investor must deposit in his account as collateral before writing options. Ad Open an IBKR account with no added spreads markups account minimum or inactivity fee. Ad Smart Options Strategies shows how to safely trade options on a shoestring budget.

Ad Open an IBKR account with no added spreads markups account minimum or inactivity fee. If you wrote 10 puts at a strike of 200 and you got assigned on them you need 200K of cold. Its not what the broker requires you to have for margin its what you need if you are assigned.

To sell options on stocks the margin requirement is quite large because of the necessary cash that must remain in the account for option assignment in a worse-case. Margin Accounts Cash Accounts. Heres how ordinary people are earning 5000 - 20000 each month in their spare time.

Answer 1 of 20. At the end of the month Im. Margin requirements vary by.

Both have an asymmetric riskreward you have a small potential profit and you bear all of the downside risk which is equal to the. Posted by 6 months ago. When you sell a option on margin you will only need to put up a of cash to cover the option.

Selling puts on margin. Short puts are equivalent to covered calls. In sum as an alternative to buying 100 shares for 27000 you can sell the put and lower your net cost to 220 a share or a total of 22000 for 100 shares if the price falls to.

Initial 1 Maintenance 2. Learn How To Trade Options Like The Pros. Ad See how this trading course helps small investors earns Extra Income.

Trader wants to own 100 shares of YHOO if price goes down to 49. With this information a trader would go into his or her brokerage account select a security and go to an options chain. For Reg T the.

Ad Trade with the Options Platform Awarded for 7 Consecutive Years. Ad Turn Every Friday Into An Extra Payday Selling Options. Buy PutBuy Put and Buy.

Does webull allow you to buysell options on margin. YHOO current market price 4970. If you are planning on making a big purchase but you think the item may go on sale in a week what would you do.

Naked Put Margin Requirement Applies when selling uncovered puts in a margin account. Open an Account Now. The expiration month.

Long Put Protective Put. Ad Increase Your Buying Power And New Strategies With Margin At TD Ameritrade. 100 Cost of the Option.

Or you could sell two XYZ 90 puts at 225 and collect 450 2 X 225 X 100 450 on. If doing pure option selling you should never get close to using margin. If you get assigned and you dont have the margin to hold them then your broker will sell them in the after or pre market and credit you any gains but will also charge you interest on the extra.

You could place a GTC limit order to buy 200 shares at 90 and wait to see if you buy the shares.

Leverage Using Calls Not Margin Calls The Options Futures Guide

:max_bytes(150000):strip_icc()/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

Short Selling Vs Put Options What S The Difference

2

Short Put Option Strategy Explained The Options Bro

Selling Put Options How To Buy Stocks For Less

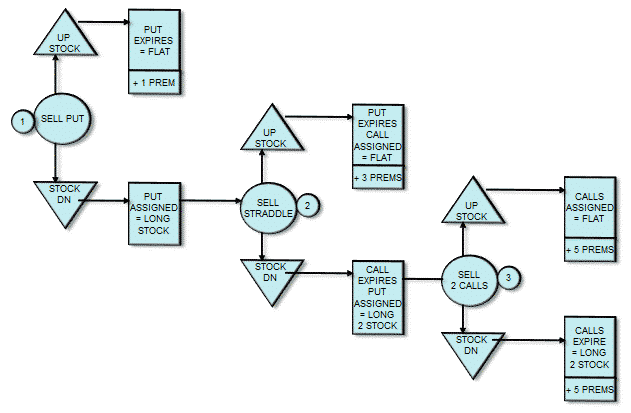

Option Strategies Don T Buy And Sell Shares Write Options Instead Seeking Alpha

Selling Index Puts Explained Online Option Trading Guide

Printing Money Selling Puts Seeking Alpha

/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

Short Selling Vs Put Options What S The Difference

Short Put Naked Uncovered Put Strategies The Options Playbook

Short Put Strategy Guide Setup Entry Adjustments Exit

The Put Option Selling Varsity By Zerodha

The Sell Put And Buy Call Strategy A Synthetic Long Stock

/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

Short Selling Vs Put Options What S The Difference

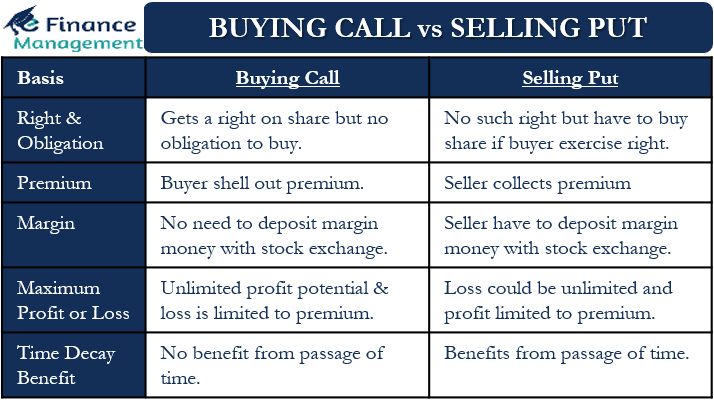

Buying Call Vs Selling Put Meaning Example And Differences

2

Margin Trading With Options Explained Warrior Trading