How much can i borrow with 100k income

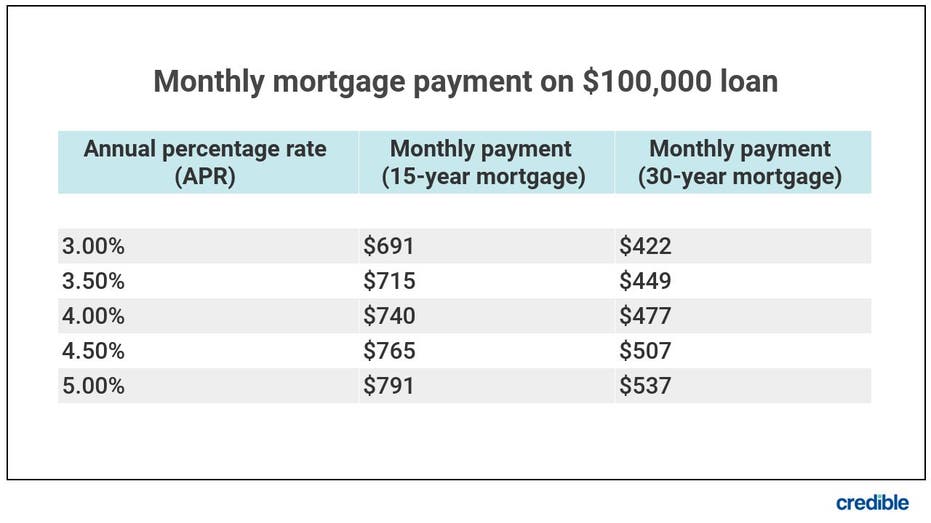

Your own rate and monthly payment will vary. One of the first questions you ask when you want to buy a home is how much house can I afford.

Become A 100k Coach

If you save an extra 5k per year and invest it at just 7 per year youll have 100k extra in your portfolio in 15 years after adjusting for inflation.

. A SIPP could therefore be an option if for example youve maxed how much you can put into a workplace pension and want to save further for your retirement or youre self-employed and want to manage your pension yourself. Some plans also have a minimum loan amount that can be requested. Then 045 or 075 up to 100k and 025 or 035 on amounts above i - Avg fund cost.

Personalized Mortgage Options Horizon Banks experienced Mortgage Advisors will help you navigate all of your loan options to find the right choice for you and your family. While the increase in the FTSE 100 and UK house prices is similar in real terms since 1984 the impact of gearing through buying a house with a mortgage means that the return on equity from a house purchase would have been much much greater than the return on an investment in the stockmarket over the period. Of course conventional mortgages can be had with just a 3 down payment though a 620 credit score is needed.

Save money by avoiding LMI. There are many reasons you may want to give a cash gift to your loved ones. With a 100000 salary you have a shot at.

The older you are the more you can borrow. Reverse Mortgage Line of Credit. Find out how much income.

And the person or people youre applying with may have more borrowing power your collective assets deposit and income means you may be able to borrow more than a single applicant. How much can I borrow. The amount you can take out of your home will depend on your age and the value of your property.

If you earn over 1 million a year President. 100k deposit 480k bank valuation 021 x100 for a percentage 21 deposit. To afford a mortgage loan worth 360k you would typically need to make an annual income of about 100k and be able to afford monthly payments worth 2000 and upwards.

The average graduate student owes up to 189000 in. Then you develop the property and sell it for 400000. Read latest breaking news updates and headlines.

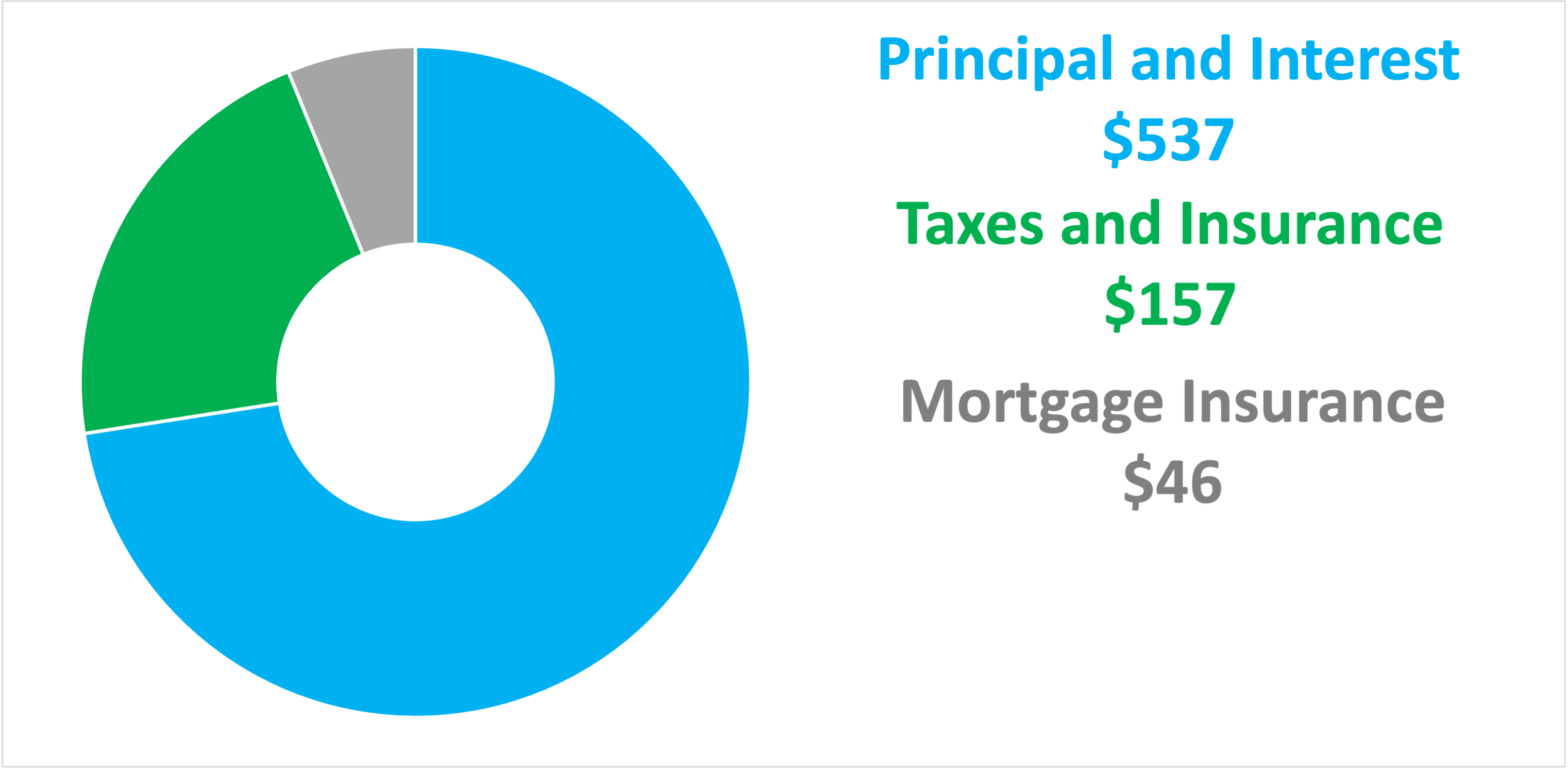

The examples above assume a 375 fixed interest rate and 3 down on a 30-year mortgage. Dont borrow all you need in one go. So borrow as little as you need now and wait as long as you can to do it again.

Factors that impact affordability. In 2021 the reverse mortgage line of credit continues to be the most popular option for homeowners when choosing how to access their funds. So if your home is worth 250000 and you owe 150000 on your mortgage you.

Property price This field is required. By default this calculator uses a 28 front-end ratio housing expenses versus income a 36 back-end ratio monthly housing plus debt payments versus income though these are variables in the calculator which you can adjust to suit your needs the limits set by your lender. To be able to borrow a 200k mortgage youll require an income of 61525 per year.

When it comes to calculating affordability your income debts and down payment are primary factors. While your personal savings goals or spending habits can impact your. Making a million dollars a year or more puts you in the top 01 of income earners in the world.

Thats pretty flexible. The key to financial success can often come down to the knowledge experience and ability of the team of advisors right in your backyard. How much can you borrow from your 401k.

With such an income you should eventually have at least a top 1 net worth of over 11 million per person. For example if you think you may need 40000 from your home to cover 20 years only take what you need now and wait to take more. By law 401k loans are limited to 50000 or 50 of your account balance whichever is less within a 12-month period.

FHA stands for Federal Housing Administration a government agency that insures the mortgage loans to help low- and moderate-income borrowers achieve the dream of homeownership. Seek places where you can grow your skill and and. The amount you can borrow with any home equity loan is determined by how much equity you have that is the current value of your home minus the balance owed on your mortgage.

If youre more ambitious and can figure out how to pull in an extra 20k per year on the side after tax and invest it at 8 per year youll have 430000 in extra money in 15 years. Many people are looking for ways to get their first 100K or ways to invest for a better retirement. If you have a medical condition you may be able to get an enhanced payment.

Have you ever wondered who makes a million dollars a year. The lending isnt conditional on your income. Some are trying to succeed as entrepreneurs.

Recent data totals student loan debt in the US. Get information on latest national and international events more. Before you invest 200k into a home youll want to be sure you can afford it.

At 175 trillion with the average college graduate carrying as much as 40000 in debt. How to calculate your home buying budget on a 50K salary. It doesnt need to be done in an office.

Your salary is certainly an important element in assessing how. 2836 are historical mortgage industry standers which are. Have a regular income this can include your Centrelink benefits.

A top 1 income is over 500000 today in America. Say you borrow 200000 and put in 50000 of your own to buy a property for 250000. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment.

It could be to help pay for a wedding a new car or university fees or to help give the younger generation a leg-up onto the property ladderOthers want to gift cash to reduce the value of their estate for inheritance tax IHT purposes with cash gift tax often being far less than the 40. And some of these jobs can be highly specialized. According to an article by AARP borrowers recognized this choice at about 66 of the time when obtaining a reverse mortgage as being the right choice for them.

For example with a 30-year loan term 5 interest rate and 5 down youd need an annual income exceeding 105000 to afford the 2478 monthly mortgage payment. 10 unexpected jobs you can do from home The pandemic has revealed one necessary truth about work. Releasing 100K in equity from a holiday home.

A 100K salary puts you in a good position to buy a home. Be over 18 years of age. The sooner you borrow the more expensive it is as the interest has longer to compound.

You can buy a home worth 220000 with a 20000 down payment and a 200000 mortgage. However the actual maximum amount you can borrow from your 401k may be less depending on what your plan allows.

How Much Mortgage Can I Afford With A 100k Salary Foundation Mortgage

Here S How Much A 100 000 Mortgage Will Cost You Fox Business

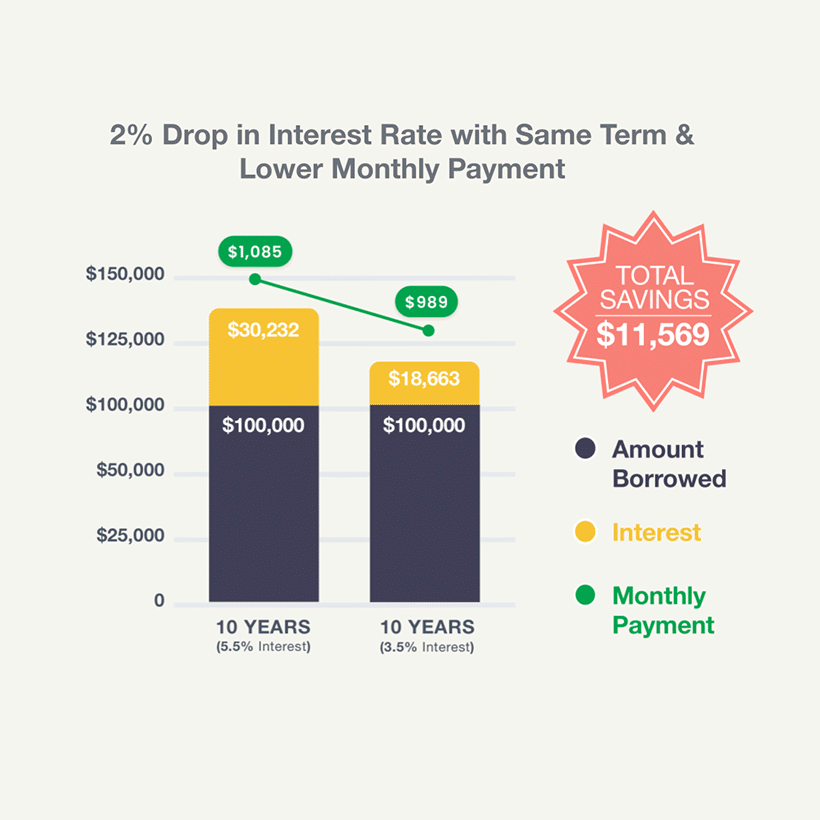

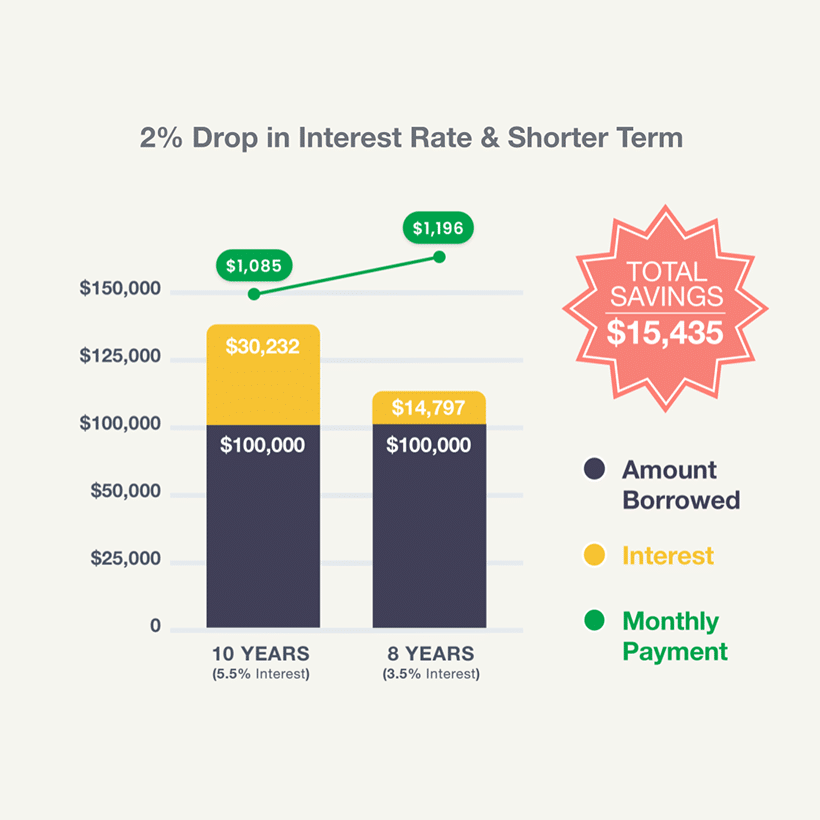

Learn How To Pay Off 100k In Student Loans Purefy

How To Write A Mind Blowingly Effective Survey Extra Money Survey Questions Surveys

Learn How To Pay Off 100k In Student Loans Purefy

Learn How To Pay Off 100k In Student Loans Purefy

Business Motivation Success S Instagram Post An Advice To Avoid Buying Things You Don T Need Remind Someone Motivation Business Tips Money Saving Tips

Here S How Much A 100 000 Mortgage Will Cost You Fox Business

How Much Mortgage Can I Afford With A 100k Salary Foundation Mortgage

How To Write A Mind Blowingly Effective Survey Extra Money Survey Questions Surveys

100k Mortgage Mortgage On 100k Bundle

How Much House Can I Afford In Texas Making 100k A Year Home By Four

Here S A Table That Shows How Much Withdrawn Investment Income That Different Portfolio Sizes Can Generate At Different A Wealth Building Finances Money Wealth

The 100k Bestseller Blueprint Learn The Proven 4 Week Formula To Your First 1 Bestseller Then Turn Your Books Into A 6 Fig In 2022 Wife Favorite City Music Business

100k Salary How Much House Can I Afford Mintco Financial

How Much House Can I Afford With A 100k Salary 2022 Propertyclub

Who Has Student Loan Debt In America The Washington Post