Calculate depreciation on home

As you can see from the formula above there are 3 variables that you need to know in. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Depreciation Rate Formula Examples How To Calculate

To calculate depreciation you need to know.

. Plus under your special clause you can also expect to receive. Step 4 Determine the Depreciation Amount The depreciation amount equates to 3636 of the adjusted basis depreciated each year. To calculate depreciation the value of the building is divided by 275 years.

The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and. The resulting depreciation expense is deducted from the pre-tax net income generated by the property. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

Ask you the insurance company calculates depreciation. And dont just take their word for it. F Future Value of Home.

Depreciation limits on business vehicles. Total Depreciation - The total amount of depreciation based upon the difference. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value.

Your kitchen claim will get you 960 ACV payout. N Time in years. To be sure that you get a fair claims.

Where A is the value of the home after n years P is the purchase amount R is the annual percentage. So the basis of the property the amount that can be depreciated would be 99000. The cost of the asset asset basis including costs for buying the asset shipping setup and training The useful life of the asset.

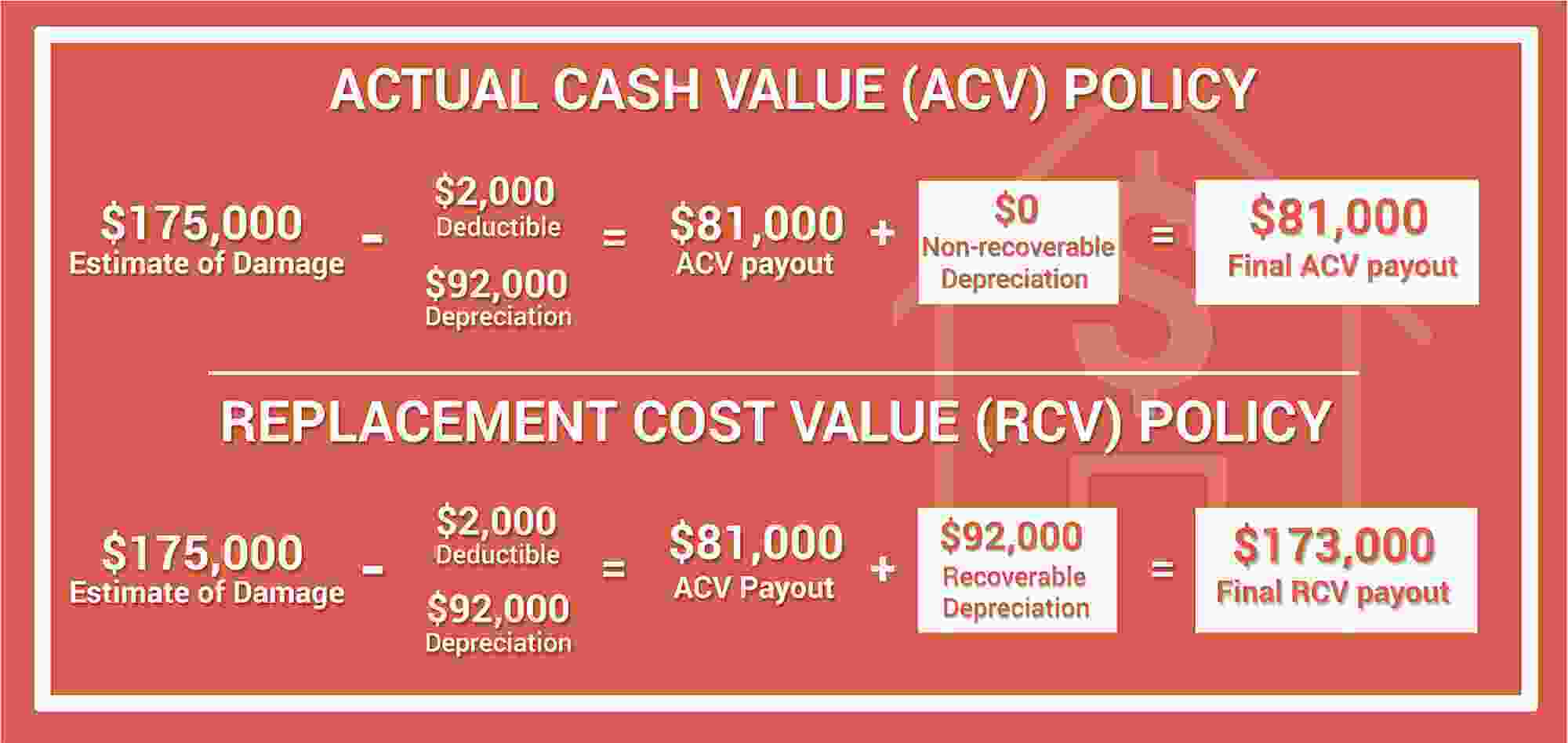

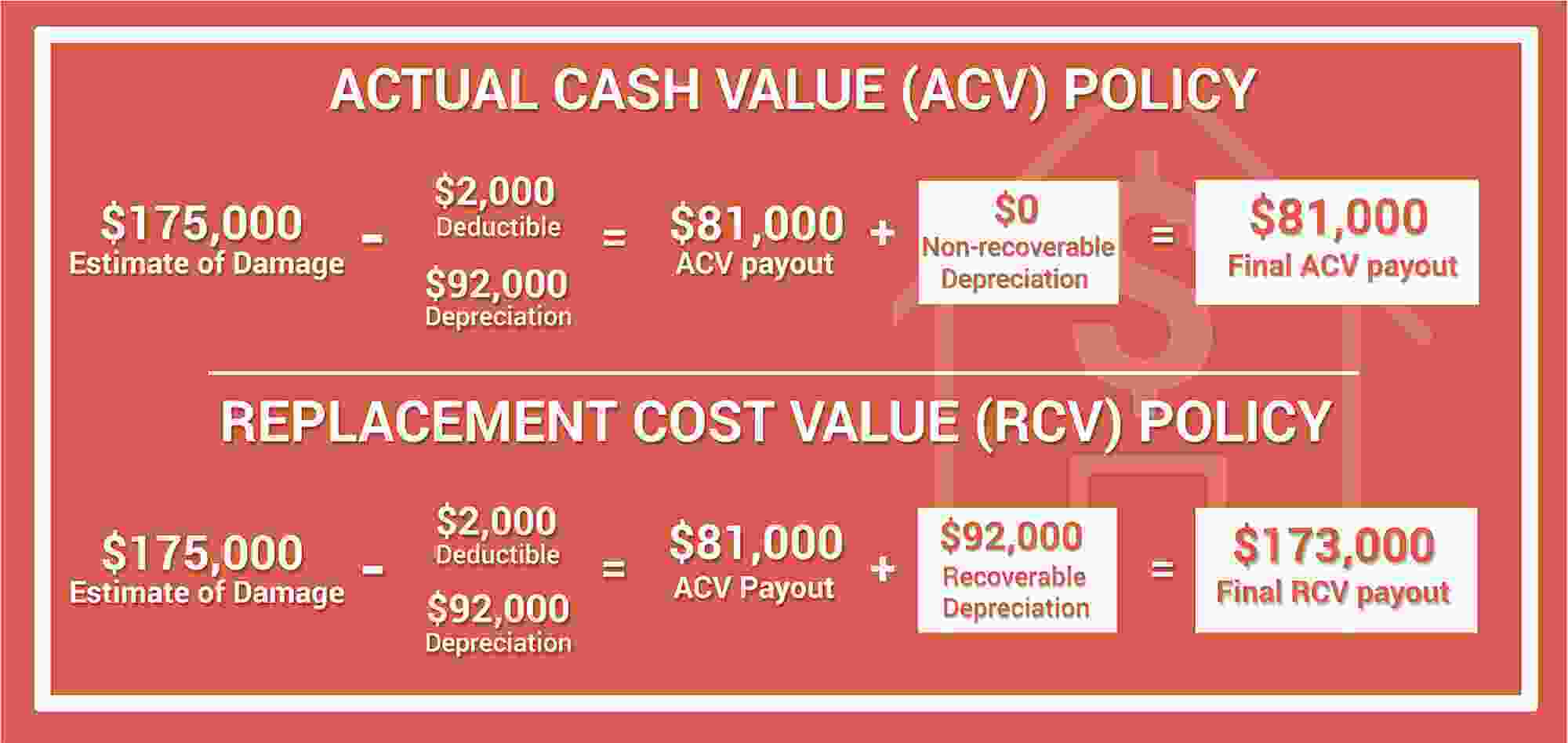

Lets say your total home area is 1800 square. You can claim 20 of your homes expenses if your office takes up 20 of your homes total space. Your home policy has a 2000 deductible.

Using the above example we can determine the basis of the rental by calculating 90 of 110000. The ratio of the two will yield your home office percentage. Start by subtracting the initial value of the investment from the final value.

First calculate the percentage of your home-office area used for businesses by dividing the total home area by your office area. Think about this. Ad Edit Sign Print Fill Online more fillable forms Subscribe Now.

The home appreciation calculator uses the following basic formula. I Interest Rate. In our example Marks asset was ready for service in.

Divide the net return by the initial cost of the investment. A P 1 R100 n. P Present Value of Home.

This calculation gives you the net return. You should know what method to use to calculate depreciation.

Depreciation Rate Formula Examples How To Calculate

How To Calculate Depreciation Expense For Business

/StraightLineBasis-bfb937d99f9d49ac9a15b8f78ca3b1a0.jpg)

Straight Line Basis Definition

Depreciation Formula Calculate Depreciation Expense

Calculating Depreciation Youtube

Free Macrs Depreciation Calculator For Excel

How To Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Depreciation Macrs Youtube

How To Calculate Property Depreciation

How To Calculate Depreciation On Rental Property

Appliance Depreciation Calculator

Replacement Cost Value Rcv Vs Actual Cash Value Acv

Depreciation Schedule Template For Straight Line And Declining Balance

Real Estate Depreciation Meaning Examples Calculations

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition